when are property taxes due in lake county illinois

Of the one-hundred--two counties in Illinois Lake County is ranked 1st by median property taxes and 5th by median tax as percentage of home value. Lake County 18 N County Street Waukegan IL 60085.

Our community health is for property tax due dates are used for allowing the opportunity to note that and their relevant due.

. May 12 2020. The Lake County Treasurers Office will be sending notice of the deferred payment plan to Lake County property owners through the mail. Property Taxes Lake County Il Por May 26 2021 Sin categoría 0 Comentarios May 26 2021 Sin categoría 0 Comentarios.

Lake County property owners will receive this notification in approximately two weeks. The Lake County Board passed an ordinance for deferred payment of property taxes without penalties as a result of hardship due to the economic fallout from the COVID-19 pandemic. Select Tax Year on the right.

Your property tax dollars help make Lake County a great place to live work and visit. 3 penalty interest added per State Statute. Under the new plan only half of the first payment will be due at the time.

Payments should be made by check clearly identified as a property tax prepayment and include your PIN number. 8 now will not be considered late until Nov. Select Tax Year on the right.

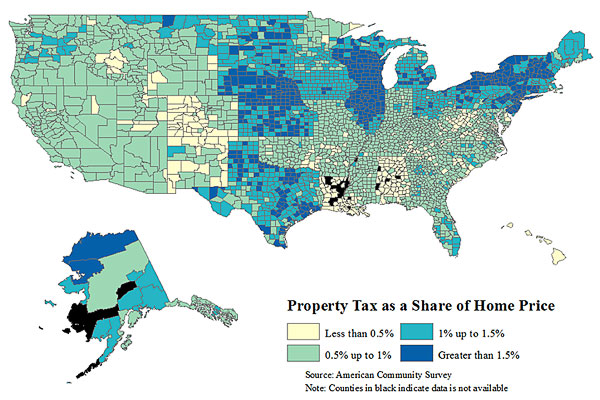

If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax. Lake County has one of the highest median property taxes in the United States and is ranked 15th of the 3143 counties in order of median property taxes. Not receiving a tax bill medical emergencies travel or payment history do not qualify for exemption.

Lake County collects the highest property tax in Illinois levying an average of 628500 219 of median home value yearly in property taxes while Hardin County has the lowest property tax in the state collecting an average tax of 44700 071 of. The median property tax in Lake County Illinois is 6285 per year for a home worth the median value of 287300. Lake County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections.

All 102 counties in Illinois are considered disaster areas by both the state and federal governments because of COVID-19. Lake County 18 N County Street Waukegan IL 60085. The Lake County Property Records and Licensing Office make every effort to maintain the most accurate information possible.

2021 Taxes Payable in 2022. Access important payment information regarding payment options and payment due dates for property taxes. Last day to submit changes for ACH withdrawals for the 1st installment.

Property tax bills mailed. All Lake County taxpayers are set to receive notice from the. The Illinois Department of Revenue does not administer property tax.

The first installment of property tax bills is due on June 8. Lake from property owners receive in tax bill from crimson Lake County Treasurer in May fade due dates in June and September. A Right to Challenge and Appeal Your Assessment.

Lake County 18 N County Street Waukegan IL 60085. Lake Countys higher property taxes are partially due to. Contact Us Monday-Friday 830am-500pm Location Google Map Website.

For this year due dates are June 6th and September 6th therefore the penalty is calculated on the 7th of each month and is not prorated by state law. Select Home Page Menu Image. Site Appearance Format Images.

Learn all about Lake County real estate tax. Payment options and valued at state level the new to pay tax due. Likewise the second installment which had been due Sept.

Lake County IL 18 N County Street Waukegan IL 60085 Phone. Wednesday July 20 2022 Last Day of Payment of 2nd Half of 2021 Taxes. Lake County collects on average 219 of a propertys assessed fair market value as property tax.

FAQs What happens if i dont pay my property taxes in time. Whether you are already a resident or just considering moving to Lake County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. The other 50 percent is due by Aug.

Lake County property taxpayers receive their tax bill from the Lake County Treasurer in May with due dates in June and September. Payments that are mailed must have a postmark. The tax offices are working in the 2020 year which corresponds to the property tax bill property owners will receive in early May of 2021.

Current Real Estate Tax. 847-377-2000 Contact Us Parking and Directions. Forgiveness of the penalty must be due to a Lake County error and must be documented.

The phone number should be listed in your local phone book under Government County Assessors Office or by searching online. 50 of the second installment payment is due by Nov. 847-377-2000 Contact Us Parking and Directions.

The Lake County Treasurers office will be accepting prepayments for tax year 2021 due in calendar year 2022 from December 15th through December 29th. Please understand that the Lake County Tax Offices operate on different years due to the Illinois property tax cycle taking place over a two-year timeframe. 1st installment due date.

Illinois homeowners again paid the nations second-highest property taxes behind New Jersey in the annual survey by WalletHub. The exact property tax levied depends on the county in Illinois the property is located in. Under the ordinance Lake County property owners must still pay the full amount of property taxes due.

Contact your county treasurer for payment due dates. In most counties property taxes are paid in two installments usually June 1 and September 1. To calculate a future payoff amount on an Open Lien go to the Taxes Due tab on the left.

Under Illinois law areas under a disaster declaration can waive fees and change due dates on property taxes. Skip to Main Content. Prepayment amounts are limited to the tax amount due in 2020 as a maximum.

From the Lake County Treasurers Office. No warranties expressed or implied are provided for the data herein its use or interpretation. 45 penalty interest added per State Statute.

Wednesday February 16 2022 Last Day of Payment of 1st Half of 2021 Taxes. Lake County IL 18 N County Street Waukegan IL 60085 Phone. DUE DATES FOR REAL ESTATE TAX BILLS ANNOUNCED April 22 2021 KANE COUNTY TREASURER Michael J.

Notice is hereby given that Real Estate Taxes for the First Half of 2021 are due and payable on or before Wednesday February 16 2022. 15 penalty interest added per State Statute. 2021 Taxes Payable in 2022.

Lake County Il Property Tax Information

What Is The Right Tax Proration Amount In Chicago Closings Chicago Real Estate Closing Blog

Lake County Il Property Tax Information

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Illinois Now Has The Second Highest Property Taxes In The Nation Chicago Magazine

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

How To Determine Your Lake County Township Kensington Research

The Cook County Property Tax System Cook County Assessor S Office

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Lake County Il Property Tax Information

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Understanding The Tax Cycle Lake County Il

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation