georgia film tax credit 2020

Georgias popular Film Tax Credit will undergo significant changes as of January 1 2021. An audit is required prior to utilization or transfer of any earned Georgia film tax credit that exceeds 25 million in 2021 125 million in 2022 and for any credit amount thereafter.

Sugar Creek Capital Film Entertainment Tax Credits

FAQ for General Business Credits.

. Third Party Bulk Filers add Access to a Withholding Film Tax Account. Georgia doled out a record 12 billion in film and TV tax credits last year far surpassing the incentives offered by any other state. Georgias Entertainment Industry Investment Act provides a 20 percent tax credit for companies that spend 500000 or more on.

Jeff Glickman JD LLM Partner-in-Charge of State and Local Tax Services at Aprio LLP. On August 4 2020 Governor Kemp signed into law HB. Georgia Tax Center Information Tax Credit Forms.

Georgia currently offers a transferable 20 base tax credit with the option of adding an additional 10 if the Georgia logo is displayed in the credits of. The states growing film industry generated about 85 billion in. The amendment to the Georgia law will reportedly streamline the process of applying for film and television tax credits in the.

The Georgia Entertainment Industry Investment Act of 2008 introduced enormous benefits for the Film and Media industry as well as other taxpayers who file Georgia income tax returns. Income Tax Credit Utilization Reports. Film and media projects produced in Georgia are allowed a tax credit for up to 30 of their expenses generated in-state.

House Bill 1037 HB. The broadening of this legislation permits a Georgia corporate fiduciary or individual taxpayer to purchase these credits to offset their Georgia income tax liability. Georgia offers multiple tax incentives for businesses and several for individuals.

Getting a state tax deduction on Schedule A of your Form 1040 for the. Unused credits carryover for five years. Some of the most popular ones available to individual filers are an education credit for private school scholarships and a film credit.

There are three main benefits for purchasing Georgia Entertainment Credits. The Georgia film tax credit program has generated more than 4 billion of tax credits since the programs inception. Qualified Education Expense Tax Credit.

To alleviate escalating concerns about the viability of the Georgia film tax credit Governor Kemp on August 4 2020 signed into law HB. According to the Motion Picture Association of America the Georgia film and TV industry created more than 92000 jobs as of mid-2018 representing. Income Tax Credit Policy Bulletins.

The 30 percent tax. A Georgia taxpayer may purchase Georgia Entertainment Credits generally for around 88 per credit and apply them to their current year or future tax returns. This is a solid fact.

1037 was drafted in response to a report released earlier this year by the Georgia Department of Audits and Accounts DOAA. Even amid the pandemic the state reported that 234 movies and TV shows filmed there during the 2020 fiscal year. On average 1 of Georgia Film Tax credit can be purchased for 087 to 090.

How-To Directions for Film Tax Credit Withholding. Brian Kemp approved changes to the Georgia Entertainment Industry Investment Incentive Act which requires mandatory audits by production companies before applying for the 30 film tax credit. Register for a Withholding Film Tax Account.

Film television and digital entertainment tax credits of up to 30 percent create significant cost savings for companies producing feature films television series music videos and commercials as well as interactive games and animation. Georgia implemented reforms earlier this year to the tax credit program which remains widely popular. Updated August 5 2020 Last week Gov.

Income Tax Letter Rulings. By Staff on December 14 2020 News. The new law appears to be in response to an audit report issued by the Department of Audits and.

Claim Withholding reported on the G2-FP and the G2-FL. The Georgia Department of Revenue GDOR offers a voluntary program. Paying less on Georgia income tax.

The Georgia film tax credit long one of the worlds most generous subsidies for the entertainment industry could be on the chopping block as the state pares spending to respond to an unprec. Jan 2 2020. ATLANTA Georgias effective but expensive film tax credit came up for discussion Thursday during a legislative hearing on deep budget cuts lawmakers will face when they resume the 2020 General Assembly session next month.

The report revealed the use of inadequate procedures by the Georgia Department of. How to File a Withholding Film Tax Return. The question now is whether the financial lure.

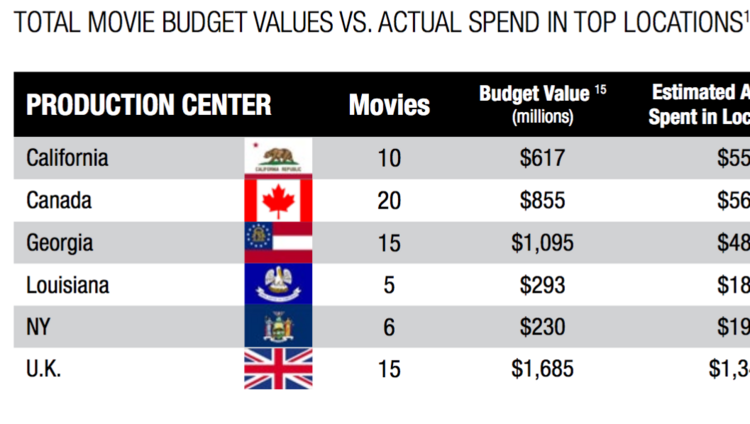

Statutorily Required Credit Report. In fiscal 2019 Georgia film and TV spending reached 29 billion for the year. Georgias generous tax credits to film and TV production companies have sparked a billion-dollar studio boom here.

1037 which enacts significant procedural changes to the states film tax credit allowed pursuant to OCGA. Instructions for Production Companies. The figure is 40 higher than the states previous record.

By Dave Williams May 28 2020 Capitol Beat News Service. Joining them now is an additional education-related tax credit this one assisting public schools.

Psa Didn T Get A Stimulus Payment You Might Need To Do This In 2021 Child Tax Credit Tax Debt Irs

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Essential Guide Georgia Film Tax Credits Wrapbook

The 3 Best Film Schools In Georgia In 2022 Premium Schools

Whizolosophy Good Things In 2020 Bee Friendly Grow Wildflowers Good Things

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Opinion Ga S Film Tax Credits Are Big Budget Flop

Georgia Film Tax Credit Could Be Capped Amid Fiscal Crisis Variety

Georgia Post Production Tax Incentives Explained Georgia Post Alliance

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia Film Records Blockbuster Year Georgia Department Of Economic Development

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Film Television And Digital Entertainment Tax Credit Georgia Department Of Economic Development

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle